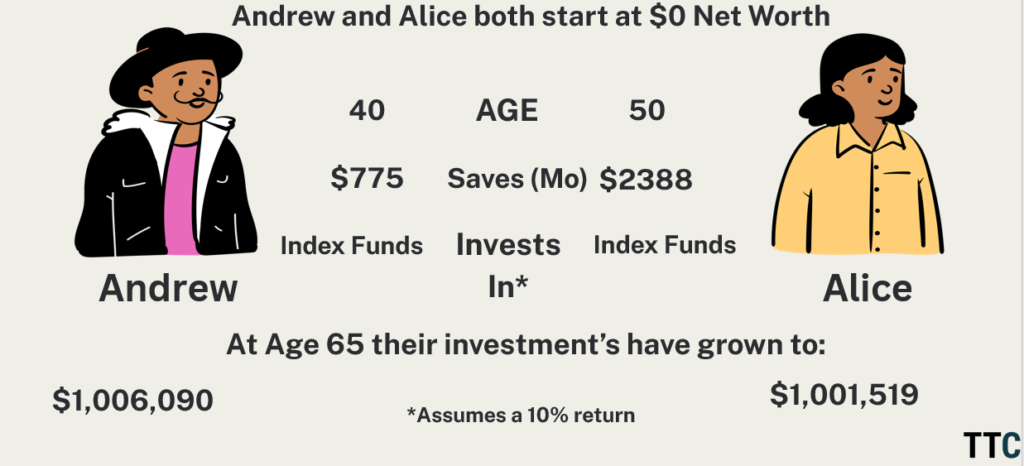

When I talk to people in their 40s about investing, a common theme that comes up is “starting late.” To help put things into perspective, I often use a 40-year investing timeframe. Naturally, the big follow-up question I get is, “What does it look like for me if I am starting late?” That’s a fair question. So, here’s what it looks like starting at 40, assuming you have $0 saved and invested.

I like to look at money through a more holistic perspective, inclusive of both psychological and behavioral lenses. By understanding both the psychology and behavioral aspects of personal finance, we can really hone in on our financial outcomes. That being said, posts like this make me a little uneasy. It’s not because the math doesn’t check out, but because it’s unrealistic to assume that someone who has never saved before will suddenly change their behavior and start saving upwards of $2000 per month without practicing intentionality and forming the necessary skills and habits for long-term investing.

Recognizing this momentous uphill climb requires an equally monumental mindset shift, and such a change in behavior is extremely difficult. If you don’t have the foundational roots and habits in place, you likely won’t remain disciplined enough to stay the course. An immediate change of this scale may require giving up luxuries, minimizing the number of subscriptions, and even eating home-cooked meals for long periods of time.

But remember, you don’t have to live with financial anxiety forever. Financial independence IS possible but it does require you to get serious and invest early and often. If something is holding you back, I can help. Send me a message and I will help you get started.