Think you’re on track to become a millionaire just by investing wisely? Think again. There’s a hidden enemy lurking in your portfolio, slowly eating away at your hard-earned gains. I’m not talking about the market crashes or bad stock picks—it’s something far more insidious and often easily overlooked: Investment Fees.

In this post, I’ll help to expose the devastating impact of just one of the types of fees, using a simple yet eye-opening hypothetical scenario to show just how much money could be lost over your investment lifetime. Buckle up, because what you’re about to learn could change the way you approach investing forever.

The Scenario

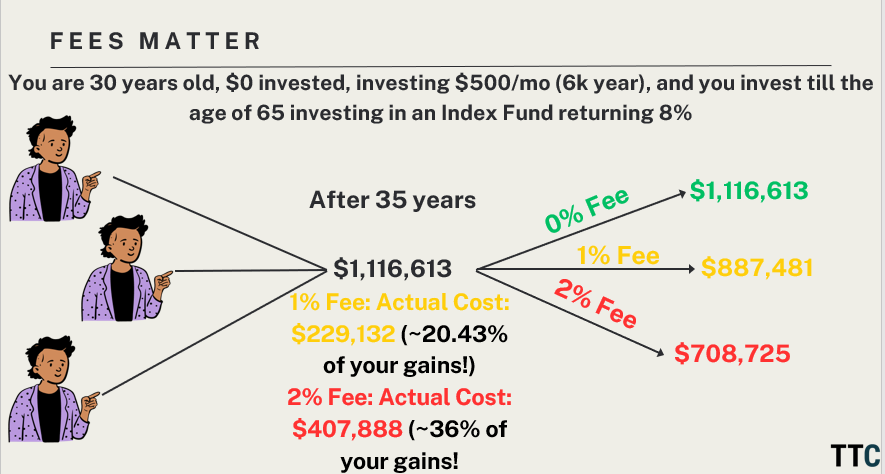

Let’s imagine you are 30 years old with no initial investments. You decide to invest $500 per month ($6,000/year) in an index fund that returns an average of 8% per year. You plan to keep this investment strategy until you reach the age of 65.

The Outcomes

After 35 years of consistent investing, here’s how your investment would perform under different fee structures:

0% Fee (No Fee):

- Final Value: $1,116,613

1% Fee:

- Final Value: $887,481

- Actual Cost of Fees: $229,132 (~21% of your gains)

2% Fee:

- Final Value: $708,725

- Actual Cost of Fees: $407,888 (~36% of your gains)

Understanding the Impact

The numbers above clearly show the significant impact that fees can have on your investment returns. Let’s break it down:

- 0% Fee: With no fees, your investment grows unimpeded, reaching a final value of $1,116,613. This represents the full potential of your investment over 35 years.

- 1% Fee: A seemingly small 1% annual fee reduces your final value to $887,481. The cost of this fee amounts to $229,132, which is roughly 21% of your total gains. This substantial reduction highlights how even modest fees can significantly erode your wealth over time.

- 2% Fee: With a 2% annual fee, the final value of your investment drops dramatically to $708,725. The fees paid in this scenario total $407,888, which is about 36% of your gains. This stark decrease illustrates how high fees can severely limit your investment’s growth.

Why Fees Matter

Fees matter because they compound over time, just like your investments. While 1% or 2% may seem negligible in the short term, these fees can add up to substantial amounts over the long haul. Here’s why:

- Compounding Effect: Just as your investments compound, so do the fees. Paying a percentage of your assets every year means that you’re not only losing that amount but also the potential growth that money could have generated.

- Reduced Returns: Higher fees directly reduce the amount of money that remains invested. This leads to lower overall returns because less money is working for you in the market.

- Long-Term Impact: Over decades, the difference between paying 0%, 1%, or 2% in fees can result in a significant gap in your final portfolio value. As shown in the scenario, the difference between no fees and a 2% fee is over $400,000!

Understanding and minimizing investment fees is crucial for maximizing investment returns. When choosing investment options, it’s essential to consider the fee structure and opt for low-cost alternatives whenever possible. By doing so, it’s possible to keep more of your money working for you and realize financial success.

Remember, it’s not just about how much you invest or the returns you earn—it’s also about how much you keep after fees. Make informed decisions and prioritize low-cost investments to build a more secure financial future.

Commentary:

The best approach to investing is the DIY route – but “Do It Yourself” doesn’t mean going without any help. It means avoiding letting a “Financial Advisor” or an individual manage your money in exchange for a “low percentage” of your portfolio. When an advisor charges you according to this model, you fall into a model commonly referred to as the Assets Under Management (AUM) model, and it can be very costly in the long run – though your financial advisor won’t tell you that.

What if Phil From Philadelphia Promises Better Returns?

Sure, but consider this: If advisors could consistently beat the market year after year, would they bother with landing the average Joe as a client? No – they’d focus on high-net-worth individuals. The point is that consistently outperforming the market is extremely difficult, and Phil from Philadelphia likely has interests that don’t align with yours.

Still not convinced? Then think about it this way: If you’re paying a 1% fee, they’d need to consistently beat the market by 1% EVERY YEAR just to break even with the market. In reality, they’d need to outperform by more than 1% to make a meaningful difference.

For instance, let’s say you invest $100,000 with an advisor charging a 1% fee. If the market returns 7% that year, your advisor would need to earn you more than 8% ($8,000) to justify their fee – and that’s before taxes and other costs (which there almost always are (think front load, back load fees))

Breakdown:

- If the market returns 7%, and you invested in the market by yourself then your investments would grow to $107,000 ($100,000 initial investment + $7,000 return).

- If you went the advisor route and assuming they beat the market and were able to get a return of 8% with a 1% fee, this would be $1,080 (1% of $108,000).

- You would be left with $108,000 – $1080 = $106,920 instead of $107,000.

- So, your total investment growth needs to be more than 8% or $8,070 ($100,000 initial + $8,070 return) to cover the fee and leave you with a net gain.

- Put it another way – If the advisor earns you 8% and charges a 1% fee, your net return is 6.92%, which is slightly less than 7% which you could have gotten yourself.

Okay –let’s assume that the advisor successfully manages to beat the market once – it happens. Let’s even assume they do it twice or three times in a row. But how sustainable is this performance? If you’re still on the fence about this, let’s look at some statistics from SPIVA (S&P Indices Versus Active). According to this article, a significant majority of active fund managers fail to outperform their benchmarks over various timeframes.

1-Year Performance (Ending June 2018)

- Large-Cap Managers: 63.46% underperformed the S&P 500

- Mid-Cap Managers: 54.18% underperformed the S&P MidCap 400

- Small-Cap Managers: 72.88% underperformed the S&P SmallCap 600

5-Year Performance:

- Large-Cap Managers: 76.49% underperformed

- Mid-Cap Managers: 81.74% underperformed

- Small-Cap Managers: 92.90% underperformed

15-Year Performance:

- Large-Cap Managers: 92.43% underperformed

- Mid-Cap Managers: 95.13% underperformed

- Small-Cap Managers: 97.70% underperformed

These statistics highlight the consistent challenge for active fund managers to outperform their benchmarks over various time horizons. Over a 15-year period (2003-2018), only one in 13 large-cap managers, only one in 21 mid-cap managers, and one in 43 small-cap managers were able to outperform their benchmark index.

So, while it is possible to “beat the market” from time to time, there’s no guarantee that this will continue in the future. The data shows that sustained outperformance by active fund managers is extremely rare.

Here’s an analogy – Imagine you’re choosing a car for a long road trip:

Option one is a flashy sports car with high maintenance costs and occasional breakdowns.

Option two is a reliable sedan known for its low costs and dependable performance.

For a smooth journey without unnecessary expenses, most would choose the reliable sedan. Similarly, if I can outperform 95% of active managers with a low-cost index fund like Vanguard or Fidelity (0.04% expense ratio), index investing is the practical choice.

So Why Do People Still Actively Invest?

First, the transactional costs of active investing are often hidden by deception. The financial industry is one of the few industries where the true costs are obscured behind closed doors and intentional confusion. If you knew you would pay about $400,000 over a 35-year period, would you really take that option? Most likely, no. Therefore, tricks like the seemingly small 1% annual fee make it sound like a negligible amount – after all, it’s only 1%, right? You think you’re keeping the remaining 99% of your money, but this is exactly what they want you to think. That 1% compounds over time, just like your investments do.

Next, like healthcare and medical bills, investments are purposefully made more complicated than they should be. This complexity keeps investors in the dark and dependent on advisors.

Third, many people don’t grasp the long-term impact of fees. Small amounts like $50 here and $75 there don’t seem significant, but unlike a dinner tab where you see the total at the end, with investing, you never get that “final bill.” Instead, you’re constantly being charged, and these small amounts add up to large sums over time. Remember, advisors make money whether you gain or lose because their annual fees (1% or 2%) are deducted from your portfolio regardless of its performance. Even if they have the best intentions, they may still not beat the market because sometimes, that’s just how the market works.

We all love stories and examples because storytelling connects us. You’ve probably heard success stories like, “I bought NVIDIA at $25 and now I’ve made over 5000%.” While exciting, such stories are rare. One bad pick can wipe out all your gains and more.

The reality is that picking stocks is like gambling. If you want fun and excitement, go to Vegas. Real investing should be boring – like watching paint dry. Don’t pick stocks, and definitely don’t pay someone else to pick stocks for you. Invest in low-cost index funds – they might not beat the market, but they will give you your fair share of the returns.